Important!

The big shift is coming! As of October 1, 2015, merchants are supposed to be “EMV Compliant”–creating a big shift in responsibility for fraud in credit card transactions. Much of the U.S. will make the shift to chip-embedded cards in the very near future–some card issuers have already begun.

Our new credit card [Verifone Vx520] terminals will now process “chip-embedded” cards and will also process “contactless” NFC payments [such as Apple Pay, Google Wallet or Softcard] usually done with a smart phone. Some say that NFC offers the most secure transaction.

Under the new system, the chip-embedded cards are much more difficult to counterfeit and or steal data from and consumer protection should be much better–if we follow the proper procedures. If we don’t do it right–we are 100% liable for any fraudulent transactions that occur in our stores.

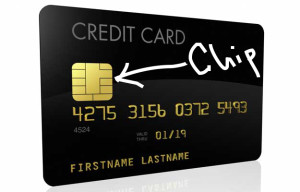

The first thing to look for on every card presented for payment, starting immediately, is the “chip”. [The square, metallic-looking, printed-circuit-looking portion on the front of the card] There is actually a tiny microcomputer embedded in the card which assigns a unique transaction code with every use. Whether a card has the “chip”, or not, will determine how you handle the transaction.

If the card has a chip:

If the card has a chip:

- Press F2 “Sale” on the terminal

- Enter the $ amount of the sale and press the Green (Enter) Key

- Put the CC terminal up on the counter with the numbers facing the customer.

- The customer needs to confirm the sale amount by pressing F1 “Yes” or F2 for “No”

- The screen will say “Card Entry/Acct“, the customer should now insert their card into the end of the terminal (under the numbers), face up, chip into the machine–until it feels like it clicks in–and leave it there. [The terminal will dial out for authorization]

- After authorization is complete, the screen will prompt the customer to “REMOVE CARD”

The terminal will then say “RETURN TERMINAL TO CLERK”. [Take the terminal back from the customer.] The terminal will then print the receipt and ask the normal “Print Customer Copy” request–F1 for “YES”, F2 for “NO”

Please have the customer sign the “Merchant Copy” (Which goes in the cash tray) and give the customer their copy. [You must always have the cardholder sign the Merchant Copy of the sales slip and give the customer their copy (at least try). Don’t ask them if they want their copy of the credit card transaction, just print it and give it to them or put it in their bag.]

This procedure changes a lot of things for us as sales clerks–the customer feels more secure because they never have to let go of their card. This also means that we are not going to have the opportunity to inspect the card–for numbers, dates, signature, names or anything else. We also won’t ask to see a cardholder’s I.D. since we won’t have anything to compare it to. If the terminal accepts the card and authorizes the transaction–we must have faith that the security measures inherent in the chip-card actually work.

The bottom line is: If we swipe or hand-enter a “chip-card”, and it turns out to be fraudulent, we are 100% responsible for the full amount of the transaction–period. If we use the terminal and process a “chip-card” following the instructions given above–and it turns out to be fraudulent, we are not liable for any portion of that transaction.

If a Chip-initiated Transaction is declined by the Issuer, the Transaction must not be processed by any other means.

Magnetic Stripe “Swipe” Cards

If the card does NOT have a chip, you may handle it the same as we have always processed credit card payments, starting with swiping the card, entering the $ amount, waiting for authorization and printing the receipts for signature–and the customer’s copy.

When a customer hands you their card for processing:

- Look at the expiration date–make sure it has valid dates.

- Check the signature on the back–it should closely resemble the customer’s signature on the charge slip. [If they have written “See I.D.” or something similar, ask to see an official form of government issued I.D., such as a driver’s license. Look at the photo and at the customer to compare. Also, compare the name on the I.D. to the credit card. Do not write anything down from the I.D.

- Technically, if a card is not signed on the back, it is not valid. The customer may sign the card in your presence with a valid. I.D. This is a rule of the credit card companies.

- You are not required to ask to see a Cardholder’s I.D. unless it is requested by the cardholder, or you are instructed by the Authorization Center to do so–this would probably only occur if the terminal has instructed you to call for an authorization. If the card is signed and you ask to see their I.D., just to confirm the customer’s identity, and they decline to show you their I.D., you may not refuse to process the card. Just remain friendly and go ahead with the transaction if everything else appears to be legitimate. You cannot require the cardholder to supply any personal information unless instructed by the Authorization Center.

- You must always have the cardholder sign the Merchant Copy of the sales slip and give the customer their copy (at least try). Don’t ask them if they want a copy of the credit card transaction, just print it and give it to them or put it in their bag.

- If you swipe a chip-embedded card–after you have entered the amount and the amount is confirmed, the terminal may say “Use Chip Reader”–at this point, press the green “Enter” button and you will have to start all over–with the chip-card instructions above.

“Contactless” (NFC) Payments

A customer wants to pay with ApplePay, Google Wallet or Softcard using their smart phone. We can do that!

- Press F2 “Sale” on the terminal

- Enter the $ amount of the sale and press the Green (Enter) Key

- Put the CC terminal up on the counter with the numbers facing the customer.

- The customer needs to confirm the sale amount by pressing F1 for “Yes” or F2 for “No”

- The screen will say “Card Entry/Acct.”, and show the following icon on the screen:

-

The customer should now hold their smart phone near the terminal with the proper app enabled (Passbook) and follow the instructions on the phone [use fingerprint (place finger on the “Home” button for iPhone) or enter passcode to authorize the transaction] [The terminal will dial out for authorization]

- Clerk can now take the terminal back for receipt printing.

- After authorization is complete, the terminal will then print the merchant receipt and ask the normal “Print Customer Copy” request–F1 for “YES”, F2 for “NO”

- There is no signature required for a “contactless” payment. Give the customer their copy (at least try). Don’t ask them if they want a copy of the credit card transaction, just print it and give it to them or put it in their bag.

Voids &/or Refunds

If a customer wants to bring items back today, always “VOID” the credit card transaction, DO NOT “REFUND” if it’s the same day as the original sale.

If they bring back an item that they bought yesterday, or last week, or at one of our other stores–you must do a “REFUND” on their credit card–you won’t be able to “VOID” it since you don’t have the original transaction in the CC terminal.

If a purchase was made with a credit card, we must process a refund only to that same credit card–we never give a cash refund for a credit card transaction. If they gave us a check, we will have to wait for the transaction to clear the bank, after which we will issue a check to the customer–we will need their mailing address and info in that case.

There is a “Quick Reference Guide” for the credit card terminals in the drawer near the Point-of-Sale system or go to the Staff Blog on the internet [staff.inhaweb.com], click on “Docs” and find it there near the top. There is also a yellow card there with the “Merchant Number” for each terminal if you need to call the “800” number (on the card) for help with the terminal or authorization, etc. Make sure you know where these items are and that they stay in the proper place and are accessible (not buried).

2 comments for “New Credit Card Terminals”